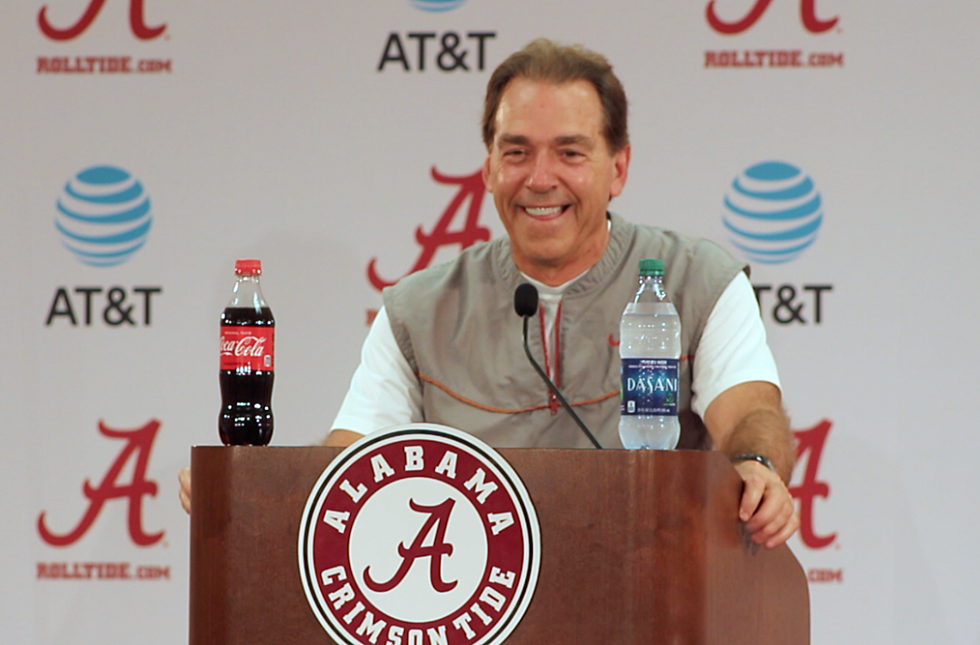

New Tax Plan Could Result in Millions Lost for College Football Programs

Tide Pride donors may no longer be able to receive a tax write-off for their donations. The Montgomery Advertiser reports that under current legislation, donors can claim up to 80% of their donations as a tax-deductible donation to charity; however, the new tax bill will repeal that deduction as of January 1, 2018. The Advertiser also reports this could mean millions of donations dollars being lost for college athletic programs.

The University of Alabama Athletics Department has urged Tide Pride members to make their annual donations before December 31, 2017.

Source: Republican tax overhaul brings major ramifications for college football programs, The Montgomery Advertiser

More From Catfish 100.1

![Vince Gill Joins Red Marlow for Powerful Duet on ‘The Voice’ Finale [Watch]](http://townsquare.media/site/204/files/2017/12/vince-gill-red-marlow.jpg?w=980&q=75)